Blockchain Technology Explained

On this page you will learn what are blockchains, what are the use cases of blockchains, and about the evolution of blockchains from generation 1 to generation 3. The video above was posted by Systems Innovation.

What are blockchains, What are the Use Cases

What is blockchain? or in better words ‘What are blockchains’?

Blockchains are decentralized networks – distributed ledgers (databases) comprised of unchangeable, digitally recorded data. This data can refer to any trade or agreement between two or more parties and is recorded into blocks. Each block is attached to the previous block using a cryptographic signature – a ‘hash’. This hash sequence creates an order that the blocks fall under which is verified by the nodes in the network.

Here is an example of a hash:

0000000000000000000aeae459af3384b7ef80eb7c6885ab6870081e885eeba2

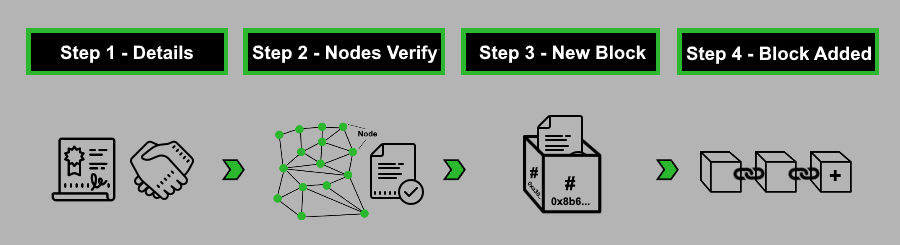

Here is the process taken to record new transactions:

Step 1. Details and digital signatures are recorded. Step 2. Nodes in the network verify details of transactions. Step 3. The verified details are recorded and added to a block (a unique hash is created for this block, and this block also includes the hash of the previous block. Step 4. The new block is added to the chain of blocks. The image below illustrates these steps.

Consensus algorithms

A consensus algorithm is an algorithm (math equation) that the nodes/users of a blockchain network use to verify the transactions happening on the network. The two most popular consensus algorithms are proof of work (POW) and proof of stake (POS).

Proof of Work (POW)

POW or Proof of work is a way that blockchains remain protected from various types of attacks. POW usually requires computing power by the service requester to solve an intensive puzzle of sorts. POW makes it much less feasible and ideally not worth it to attack or spam a blockchain and to use it as it is intended.

Proof of Stake (POS)

Instead of computational power being used as is the case in POW by miners. In a POS system, the creator of the new blocks is determined at random, within the parameters of variables such as how much of that cryptocurrency a user is holding, and in some cases for how long they have held that cryptocurrency. POS uses far less energy than POW making it more cost-effective and relieves pressure from the network to release new tokens as a reward.

What makes blockchain technology secure?

Distributed/decentralized

Blockchains are more secure over centralized networks because they are distributed. There is no central point that can be attacked that can harm the integrity of the system as a whole. This is of course if there are no bugs/weaknesses in the code.

Nodes constantly verifying the hash given to blocks

Each block of data includes the hash of the previous block which allows constant verification of the integrity of the network. If any attack or change is made that is not agreed upon by the different nodes, the hash will no longer match and will not be accepted by the network.

Control/ownership over your own private keys

A private key can access a digital wallet by itself with no password or other verification required. You are the only one who will be given this private key. It is up to you to keep it secured.

Here is an example of a private key:

5Kb8kLf9zgWQnogidDA76MzPL6TsZZY36hWXMssSzNydFXYB9KF

You may be asking yourself: ‘if simply a string of numbers/letters with no further verification can unlock my digital wallet, what’s stopping other people or computers from just guessing random numbers until my digital wallet is unlocked?’

This is a great question and one that many people ask. Theoretically yes, it is possible for a private key to be guessed. But let’s crunch some numbers to see how probable this scenario is.

Private keys are written in ‘hexadecimal‘, a positional numeral system that uses a combination of numbers (0-9) and letters (A-F or a-f). Private keys are often displayed as a ‘seed phrase’ (12 or 24 random words). Let’s use an example of a dictionary with 2048 words and a seed phrase of just 12 words. This allows for 2048^12 combinations. This number is written down here below:

5,444,517,900,000,000,000,000,000,000,000,000,000,000 (total private keys possible)

Let’s do a calculation to see how many wallets each person could have if all 7.5 billion people each had an equal number of wallets/keys.

Keys for each person on Earth:

(2048^12) / (7,500,000,000) = 725,935,720,000,000,000,000,000,000,000

It is hard to fathom just how large this number is. Let’s compare it to two other numbers that are insanely large:

Keys for each grain of sand on Earth:

(2048^12) / (10^19) = 544,451,790,000,000,000,000

Keys for each Star/Planet in the Universe:

(2048^12) / (10^23) = 54,445,179,000,000,000

It would take a very very very long time to guess a private key that is in use and the chance of the wallet actually having any funds in it is extremely small as well. All this would be to attempt to compromise just one digital wallet. This would not interfere with the blockchain network as a whole. Currently, at the time of writing this there are only about 5 million Bitcoin addresses with over $100 in them. Attempting to guess one of these would take millions if not billions if not quadrillions of years.

So as long as you have your private keys secure and you are not leaving the private key/seed phrase written on a sticky note attached to your monitor, or sitting as a file labeled ‘blockchain private key’ then you should be fine for the foreseeable future.

What are blockchains used for?

Blockchains have many use cases, but they are not the solution for everything. As the first rule of thumb to keep in mind if you are thinking about integrating blockchain technology with your project, you should take a moment to think… ‘does my project use a database’? If the answer is no, then odds are that blockchain technology is not right for your project. If your project does require the use of a database, and also has multiple users who interact with it, who need to trust one another – then incorporating blockchain technology may very well make sense.

Here are some of the use cases that are being focused on by some of the top projects in the blockchain and crypto space:

1. Blockchain as a means of storing records

⦁ Voting

⦁ Shared data within an organization

⦁ Auditing purposes

⦁ Finances and digital assets (tokenization)

2. Development platforms

⦁ Smart contracts

⦁ Dapps (decentralized applications)

3. Connectivity and Autonomy

⦁ Devices communicating with other devices

What roadblocks and challenges are blockchains of today facing?

Scalability + Fees – Blockchains are still slow and can only process so many transactions per second. As the networks get busy and more transactions need verified the transaction fees (gas/fuel) go up and the networks get slower. Bitcoin processes around 7 transactions per second on average, and Ethereum processes 15 transactions per second on average. Compare this with the 24000 transactions per second that networks such as Visa process.

Widespread adoption – Blockchain technology although rapidly developing has not reached widespread adoption. How could it? We need more time for the industry, regulations, and interest to evolve.

Government regulations – In the US the SEC is taking its time to let the industry evolve and has rejected many proposals for various cryptocurrency requests. In countries such as China, Pakistan, Indonesia, Vietnam cryptocurrencies are prohibited. Other countries are still trying to figure out how to regulate cryptocurrencies and how to control them if at all possible.

Trustworthiness – For a technology that is suppose to make the world a more transparent and trustworthy place blockchain technologies have.. a lot f people think that cryptocurrencies are used mainly for illicit activities – which is simply not true.

Stability – For Bitcoin and other cryptocurrencies to be taken seriously by major investors and the public at large there needs to be more stability. This is something that will take time. With such a small market cap of around 200 to 300 billion (US) the market is easily manipulated.

Understanding of blockchain technology – Most people have never heard of blockchain or cryptocurrencies and those who have heard of it, very few actually understand what this industry is all about.

51% attack – When a company, individual, or group of individuals control 51% or more of the computing power (hashing power) of a network they can decide which version of the blockchain is telling the truth. This can bring back the issue of double spending as the group controlling the majority can make their chain of blocks the main ‘blockchain’. This is however difficult to do as to accomplish this you need to have more computing power than the rest of the network combined.

Blockchain timeline | Blockchain generations

We are still in the early years of this new technology. Just as the internet took a few decades to really take off blockchain still needs time to evolve.

1st generation cryptocurrencies (what are blockchains 1.0)

The first generation of cryptocurrencies and blockchain is technology such as Bitcoin. The big triumph of the first generation of cryptocurrencies was the ability for them to turn nothing into something. Nothing but a distributed ledger and digital numbers turning into something of value that people would pay fiat money for, would use computing power to mine and to speak highly about.

Blockchain 1.0 also solved the problem of double spending. Double spending was a problem that made digital currency not very secure because it was hard to make sure it was not being used more than once. An example being if I only have $10 and I send person ‘B’ $10 and then I also quickly send person ‘C’ $10 I have just spent more money than I should have. Blockchain technology solves this through verification from multiple nodes through consensus algorithms.

Bitcoin technology can be leveraged and upgrades/forks will make it more scalable, efficient, and affordable as it evolves. In the meantime, Blockchain 2.0 has been introduced by Ethereum.

2nd generation cryptocurrencies (what are blockchains 2.0)

A problem with the 1st generation blockchain is that it is not developer-friendly and is designed for a specific use case. Transferring bitcoin peer to peer. The 2nd generation of cryptocurrencies gets more specific to anyone looking to apply blockchain technology to their own project or industry.

Blockchain 2.0 can be seen as the introduction of a programming language and smart contracts (Ethereum). Now blockchains can be used for far more use cases then the first generation was capable of. An issue with the 2nd generation of blockchain technology is that the networks get slower and more congested as as usage increases. This is a scalability issue and a design that is not practical as not very much can run on blockchain 2.0.

3rd generation cryptocurrencies (what are blockchains 3.0)

This brings us to the 3rd generation of cryptocurrencies. We are at the forefront of blockchain 3.0 and it aims to solve scalability issues. This means that as more people use next generation blockchains they will get faster and more powerful. Similar to BitTorrent where the more people who are downloading and watching a popular movie the faster new people can download it as well. Likewise, a movie that is not very popular and does not have many people downloading it will download slower.

The second issue that blockchain 3.0 aims to solve is distribution/agility of the data being shared and verified between the users/nodes. Current blockchains each have a full of the blockchain records which as new records occur year over year the size required to store the full database gets increasingly larger. It will get to the point where not very many nodes can store the blockchain. Next gen blockchain aims to solve this.

Interoperability is another obstacle that blockchain 3.0 will make easier and seem more seamless. This means that there will likely be 100’s if not 1000’s of popular cryptocurrencies in the future. As it stands today cryptocurrencies are isolated in there own little worlds that do not communicate very well with one another. Next gen blockchain aims to solve this (Cardano, Ethereum Upgrades).

We hope this information on ‘what are blockchains‘ helps you in your journey into blockchain and cryptocurrencies. share if you found this information useful and consider subscribing to receive updates when we release more articles and videos such as this one.

Guide to Understanding Blockchain and Cryptocurrencies

Watch Crypto Session 1 | Blockchain and Crypto Terms You Should Know

Watch Crypto Session 2 | Blockchain Technology Explained + Use Cases